Carat by Carat: Unpacking the Value of Gold

Understanding Gold Pricing: Why "1 Carat Gold Price" Can Be Confusing

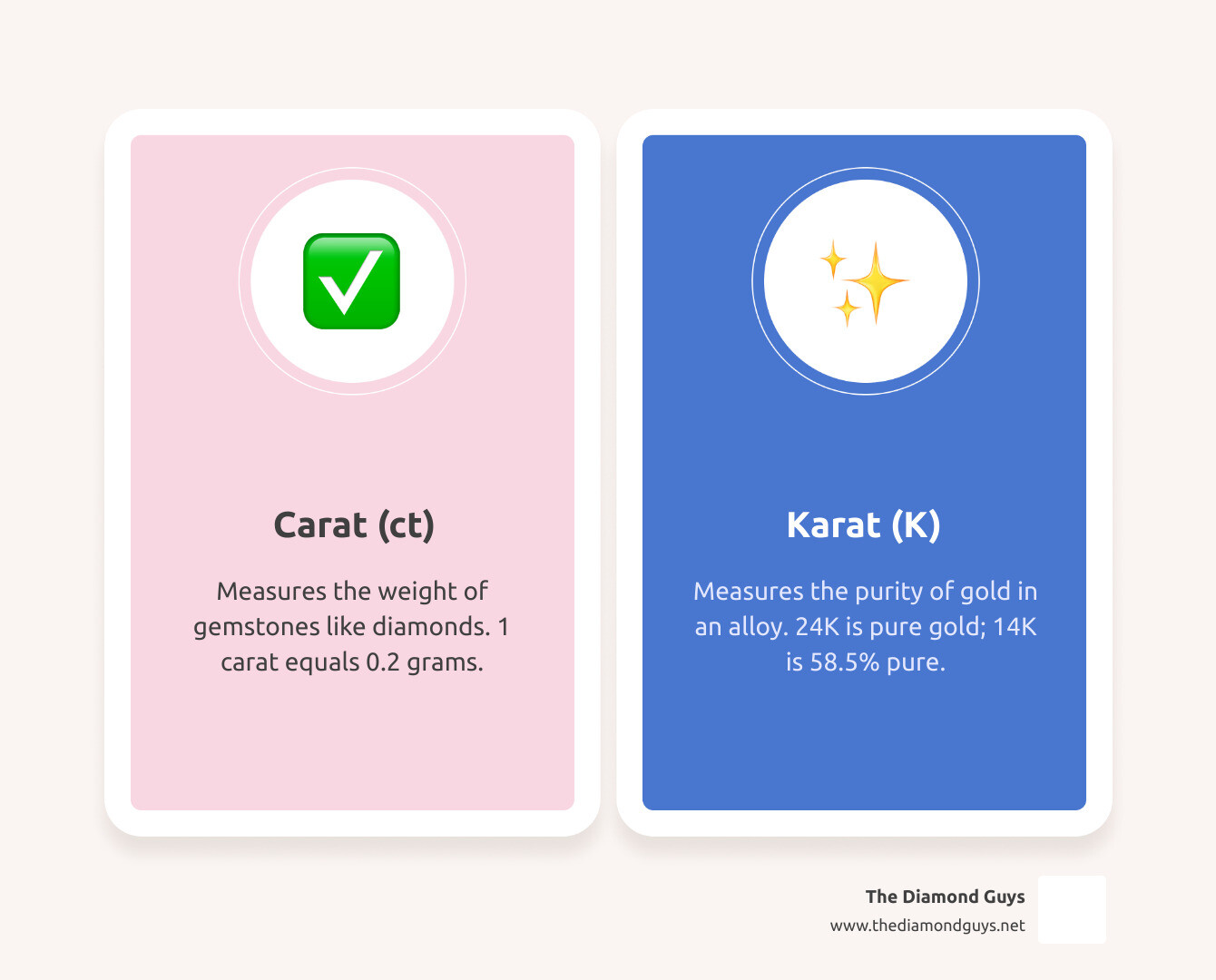

The 1 carat gold price is a term that often confuses people, and for good reason—it mixes two different measurement systems that shouldn't be combined. Here's what you need to know:

Quick Answer:

- Carat measures the weight of gemstones (like diamonds), where 1 carat = 0.2 grams

- Karat measures the purity of gold (like 14K or 18K gold)

- Gold is priced by weight (grams, ounces) and purity, not by "carats"

- If you want the price of 0.2 grams of pure gold (the weight equivalent of 1 carat): multiply the current gold price per gram by 0.2

| Unit | What It Measures | Example |

|---|---|---|

| Carat (ct) | Gemstone weight | 1 carat diamond = 0.2 grams |

| Karat (K) | Gold purity | 14K gold = 58.5% pure gold |

When most people search for "1 carat gold price," they're likely thinking about either the gold setting in a 1-carat diamond ring, or they've confused carat (gemstone weight) with karat (gold purity). The reality is that gold pricing works completely differently than diamond pricing.

Based on current market data, pure gold costs approximately $70-80 USD per gram. This means the gold equivalent to the weight of a 1-carat diamond (0.2 grams) would cost roughly $14-16 USD in raw material value—though you'd never actually buy gold in such a small quantity, and retail jewelry prices include much more than just the metal cost.

In this guide, we'll break down exactly how gold is priced, why the carat/karat confusion exists, what factors influence gold prices, and what you actually pay when buying a gold setting for your diamond jewelry.

I'm Morgan Price, and I've spent years helping people understand the real costs behind precious metals and gems, including explaining the 1 carat gold price question. This guide will give you the transparent information you need to make confident jewelry decisions.

How Gold Purity (Karat) Determines Price

Understanding gold pricing starts with its purity, which is measured using the karat system. Unlike "carat" for gemstones, "karat" (often abbreviated as "K" or "Kt") tells us the proportion of pure gold in an alloy. Pure gold is incredibly soft, so it's typically mixed with other metals like copper, silver, or zinc to increase its durability, alter its color, and make it more suitable for jewelry.

The karat system is based on a scale of 24 parts. So, 24-karat (24K) gold is considered 100% pure gold, or as close as possible (often hallmarked as 999, meaning 99.9% pure). It's a bright yellow and relatively soft metal. While beautiful, 24K gold is too pliable for most everyday jewelry, making it prone to scratches and bending.

For jewelry, gold is usually alloyed to create different karats:

- 18K gold contains 18 parts gold and 6 parts other metals, meaning it's 75% pure gold. This higher purity gives it a rich yellow color and is a popular choice for fine jewelry, offering a good balance between purity and durability.

- 14K gold consists of 14 parts gold and 10 parts other metals, making it 58.5% pure gold. It's more durable than 18K gold and is a very common choice for engagement rings and other jewelry that sees daily wear. The lower gold content makes it more affordable and resistant to scratches.

- 10K gold is 10 parts gold and 14 parts other metals, equating to 41.7% pure gold. This is the least pure gold commonly used in jewelry but also the most durable and affordable.

The choice of gold alloy also influences its color. While yellow gold is the most traditional, mixing gold with different alloys can create white gold (often with palladium or nickel) or rose gold (with copper).

The price of gold jewelry is directly tied to its purity. A gram of 24K gold will always be more expensive than a gram of 18K gold, which in turn will be more expensive than a gram of 14K gold, and so on. For instance, if 24K gold (99.9% pure) has a melt value of around $75/g, then 14K gold (58.5% pure) would be valued around $43.88/g, and 10K gold (41.7% pure) about $31.28/g. These figures represent the raw material value, before any design or craftsmanship is added.

When we consider the 1 carat gold price in the context of jewelry, it's crucial to remember that the "carat" refers to the diamond, not the gold. The gold setting will be priced based on its weight (in grams or ounces) and its karat purity. We believe that understanding these distinctions is key to making informed decisions about your precious jewelry. To dig deeper into how gold and diamonds complement each other, explore our guide on Gold and Diamonds: A Match Made in Jewelry Heaven. For more detailed insights into gold purity, you can also learn more about gold purity on our site.

Understanding the Global Gold Market and the 1 Carat Gold Price

Gold is a global commodity, traded continuously around the world. Its price is in constant flux, reacting to a myriad of economic and geopolitical factors. The fundamental price of gold is known as the "spot price," which represents the current market value of one troy ounce of pure gold available for immediate delivery. While the global spot price is often quoted in U.S. Dollars (USD), it's then converted into local currencies, such as the Canadian Dollar (CAD) or Indian Rupee (INR), for regional markets. You can learn more about what the spot price of gold is from industry authorities such as the London Bullion Market Association.

In the US and globally, gold prices are typically quoted in standard units of weight: per gram, per ounce (specifically, the troy ounce, which is about 31.1035 grams), or per kilogram. These units are essential for tracking the value of gold bullion, coins, and scrap gold. For example, you might see the price of a 1 oz American Gold Eagle coin listed, or a 1 gram gold bar from a reputable refiner sold for a price slightly above the spot value per gram.

The global nature of gold means that its price reflects a complex interplay of international market forces. This constant movement is why tracking real-time data is so important for anyone interested in gold, whether for investment or for understanding the base value of their jewelry.

Calculating the Price of 1 Carat (0.2 Grams) of Gold

Let's address the core confusion directly: what is the price of 1 carat of gold? As we've established, "carat" is a unit of weight for gemstones, equal to 0.2 grams. So, when people ask for the 1 carat gold price, they are effectively asking for the price of 0.2 grams of pure gold.

To calculate this, we take the current spot price of pure gold per gram and multiply it by 0.2. Based on recent market data, the price of 1 gram of pure gold is approximately $75 USD.

Therefore, the raw material cost for the gold equivalent of 1 carat (0.2 grams) would be: $75 USD/gram * 0.2 grams = $15 USD

This figure represents the theoretical raw melt value of 0.2 grams of pure gold. This is a very small quantity of gold, far less than what would be used in a typical piece of jewelry, and it does not include any costs for manufacturing, design, or retail markup. It's purely the intrinsic value of that specific weight of gold. You would not typically buy gold in such a tiny increment, as the transaction costs would far outweigh the material value.

Factors That Influence the Daily Gold Price

The price of gold is not static; it fluctuates throughout the day, week, and year. These fluctuations are influenced by a combination of global and regional factors:

- Supply and Demand: Like any commodity, if the supply of gold is limited while demand is high (perhaps due to increased investment interest or industrial use), prices tend to rise. Conversely, an oversupply or decreased demand can lead to price drops.

- Central Bank Policies: Central banks worldwide hold significant gold reserves and their buying or selling activities, as well as monetary policies (like interest rate changes), can greatly impact gold prices. Gold is often seen as a hedge against inflation, so when central banks print more money or keep interest rates low, gold becomes more attractive.

- Currency Fluctuations: Since gold is primarily benchmarked in U.S. Dollars, a weaker USD typically makes gold cheaper for buyers using other currencies, thus increasing demand and potentially driving up the USD price of gold. Conversely, a stronger USD can make gold more expensive and reduce demand.

- Geopolitical Events and Economic Uncertainty: Gold is often considered a "safe-haven" asset. During times of political instability, wars, or economic crises, investors tend to flock to gold, driving its price up.

- Inflation: As the cost of living rises (inflation), the purchasing power of fiat currencies decreases. Gold, with its intrinsic value, often maintains its purchasing power during inflationary periods, making it a desirable investment.

These factors constantly interact, creating the dynamic market we see for gold. For those interested in tracking these movements in real-time, you can view a Live Gold Price Chart on our website. This constant movement means the answer to "How does the price of 1 carat of gold fluctuate?" is the same as how any amount of gold fluctuates – it's tied to these global market forces.

How the 1 Carat Gold Price Varies by Currency

While the global spot price of gold is generally set in U.S. Dollars, its price in local currencies can vary significantly due to exchange rates. This means the 1 carat gold price (or rather, the price of 0.2 grams of gold) will differ depending on whether you're looking at U.S. Dollars (USD), Canadian Dollars (CAD), or Indian Rupees (INR), for instance.

Let's compare the approximate prices of pure gold (24K) across these major currencies, based on recent market data. 1 carat of gold is equivalent to 0.2 grams.

| Unit | Currency | Price per Gram | Price per 1 Carat (0.2g) |

|---|---|---|---|

| Pure Gold | USD | $75.00 | $15.00 |

| Pure Gold | CAD | $102.75 | $20.55 |

| Pure Gold | INR | ₹6,270.00 | ₹1,254.00 |

Note: These prices are approximate and subject to change based on real-time market fluctuations and exchange rates.

As you can see from the table, the numerical value for 0.2 grams of gold changes dramatically depending on the currency. This is not because the intrinsic value of the gold itself changes, but because the purchasing power and exchange rate of each currency against the U.S. Dollar (the global standard for gold pricing) are different.

For example, if the Canadian Dollar weakens against the U.S. Dollar, the price of gold in CAD might rise even if the USD gold price remains stable, making gold more expensive for Canadian buyers. Conversely, if the USD strengthens, gold might appear cheaper in the U.S. while remaining stable or even increasing in other currencies. This exchange rate impact is a critical factor when comparing gold prices internationally.

From Raw Gold to Fine Jewelry: Spot Price vs. Retail Price

When we talk about the 1 carat gold price, especially in the context of jewelry, distinguish between the "spot price" (or melt value) and the "retail price." The spot price, as discussed, is the current market value of pure, unworked gold. The retail price of a finished gold jewelry piece, however, is significantly higher than its melt value.

This difference isn't arbitrary; it accounts for several "value-added" factors:

- Craftsmanship and Design: The skill and artistry involved in changing raw gold into a beautiful ring, necklace, or pair of earrings add considerable value. Intricate designs, specialized setting techniques, and unique finishes all contribute to the final price.

- Labor Costs: Jewelers, designers, and artisans spend hours on each piece. Their expertise, time, and effort are factored into the retail price.

- Overhead Costs: Retail jewelers have operational expenses, including rent, utilities, insurance, security, and staff salaries. These costs are distributed across their products.

- Designer Premium: Pieces from renowned designers or luxury brands often carry a premium due to their reputation, exclusive designs, and perceived prestige. For example, designer jewelry from companies like Tiffany or Cartier may qualify for higher rates even when reselling, due to their brand recognition and quality.

- Retailer Markup: Like any business, jewelers apply a markup to cover their costs and generate a profit. This allows them to sustain their operations and continue offering high-quality products and services.

- Testing and Certification: Ensuring the purity and authenticity of gold (and diamonds) involves specialized testing and sometimes certification, which adds to the cost.

So, while the intrinsic value of 0.2 grams of pure gold might be around $15 USD, a finished piece of jewelry containing that amount of gold, let alone a ring designed to hold a 1-carat diamond, will cost much more. The "spot price" serves as a baseline, but the "retail price" reflects the complete value chain of fine jewelry. This is the fundamental difference when considering the "spot price versus retail price" for gold, whether in the US or internationally.

The Price of Gold in a 1-Carat Diamond Ring

This is where the term "1 carat" truly applies in jewelry—to the diamond, not the gold. When someone refers to a "1 carat diamond ring," they are talking about a ring featuring a diamond that weighs 1 carat (0.2 grams). The gold in that ring is a separate component, priced by its weight and purity (karat).

The cost of the gold setting in a 1-carat diamond ring will depend on several factors:

- Gold Purity (Karat): As discussed, 18K gold will be more expensive per gram than 14K gold.

- Weight of the Setting: A delicate solitaire setting will use less gold than a more elaborate halo or pavé setting. For instance, a typical solitaire engagement ring might contain anywhere from 2 to 5 grams of gold, but this can vary greatly.

- Design Complexity: Intricate designs require more labor and specialized techniques, increasing the overall cost beyond the raw gold weight.

So, while the diamond is the "1 carat" star of the show, the gold provides its beautiful stage. The gold's price contributes to the overall cost of the ring, but it's distinct from the diamond's price. For a deeper dive into understanding diamond sizing, refer to our article on What is Diamond Carat Size. We also encourage you to learn about What Diamond Clarity is Best to truly understand all the components that make up your dream ring.

Regarding the typical units used to quote gold prices, it’s always per gram or per ounce for the metal itself. The term "1 carat" is reserved for the diamond's weight. So, while you might buy a 1-carat diamond set in a 14K gold ring, the gold component would be quoted in grams of 14K gold, not "carats of gold."

Where to Buy and Sell Gold and What to Look For

While our primary focus at The Diamond Guys is serving our clients in Scottsdale, AZ, and Los Angeles, CA, the principles for buying and selling gold are universal. Whether you're looking to buy physical gold or sell existing pieces, finding a trustworthy buyer is paramount.

When looking to buy or sell gold, it's important to work with reputable dealers. For investment-grade gold, sovereign mints like the U.S. Mint produce highly recognized and liquid coins, such as the American Gold Eagle. These products carry a premium over the spot price due to their quality and government backing, but they are trusted by investors worldwide.

For those in the market for gold jewelry, or looking to sell existing pieces, finding a trustworthy buyer is the most important step. Whether you're in Arizona, California, or elsewhere, here's what you should look for:

- Transparency in Pricing: A reputable buyer will openly explain their pricing, ideally referencing live market rates. They should clearly explain how they calculate their offer based on the spot price, purity (karat), and weight of your gold.

- Accurate Testing and Evaluation: Ensure that any testing of your gold (e.g., for purity) is done in front of you using professional tools like XRF scanners or other industry-standard methods. This guarantees that you understand how your gold's purity is determined.

- Clear Explanation of Fees and Deductions: Ask about any fees or deductions before agreeing to a sale. A trustworthy buyer will be upfront about their process.

- Reputable and Accredited Dealers: Look for businesses with strong positive reviews and a long-standing reputation in the community. Accreditations from organizations like the Better Business Bureau (BBB) can also be a positive sign.

- Immediate and Secure Payment: Confirm the payment process and timeline before finalizing the transaction. A professional buyer will ensure payment is made securely and promptly.

At The Diamond Guys, we pride ourselves on being a trusted source for all your diamond and gold needs. We extend these best practices to our clients in Scottsdale, AZ, and Los Angeles, CA, offering expert guidance whether you're buying a custom engagement ring or looking to sell your precious metals. If you're in our service areas and looking for a reliable place for transactions, you can find a branch for transactions or contact us directly.

Conclusion: Making an Informed Gold Purchase

Navigating gold pricing, especially when terms like "carat" and "karat" are often confused, can feel like a complex journey. But with the right knowledge, you can make confident and informed decisions.

Let's recap the key takeaways:

- Carat vs. Karat: "Carat" (ct) refers to the weight of gemstones (1 carat = 0.2 grams), while "karat" (K) denotes the purity of gold. So, the 1 carat gold price technically refers to the value of 0.2 grams of gold, which is a very small raw material cost.

- Gold Pricing: Gold is priced by weight (gram, ounce, kilo) and purity (karat). The higher the karat, the higher the gold content and thus the higher the price per gram.

- Spot Price vs. Retail Price: The spot price is the intrinsic market value of raw gold. The retail price of jewelry includes significant additional costs for craftsmanship, design, labor, overhead, and retailer markup. These factors mean a finished gold item will always cost substantially more than its melt value.

- Market Fluctuations: Gold prices are dynamic, influenced by global supply and demand, central bank policies, currency exchange rates, and geopolitical stability.

At The Diamond Guys, we are committed to providing expert guidance and a personalized shopping experience. Whether you're selecting the perfect 1-carat diamond for an engagement ring, understanding the value of its gold setting, or looking to sell your gold, we ensure transparency and clarity. Our expertise in both natural and lab-grown diamonds, combined with our ethical sourcing practices, sets us apart.

We believe that every purchase and sale of precious metals should be straightforward and trustworthy. If you're looking for guidance on your next diamond purchase, let us help you Shine Bright: Navigating Diamond Purchases with Expert Guidance. And if you're considering selling your gold, we invite you to Sell your gold with confidence through our transparent and fair process at our Scottsdale, AZ, and Los Angeles, CA, locations.