From 'I Do' to 'I Paid': Navigating Wedding Ring Set Financing with Confidence

Your Journey to Dream Rings: Understanding Financing

Choosing the perfect wedding rings is exciting, but the budget can be a concern. With the average engagement ring costing around $6,000, exploring smart wedding ring sets financing is a practical step for many couples.

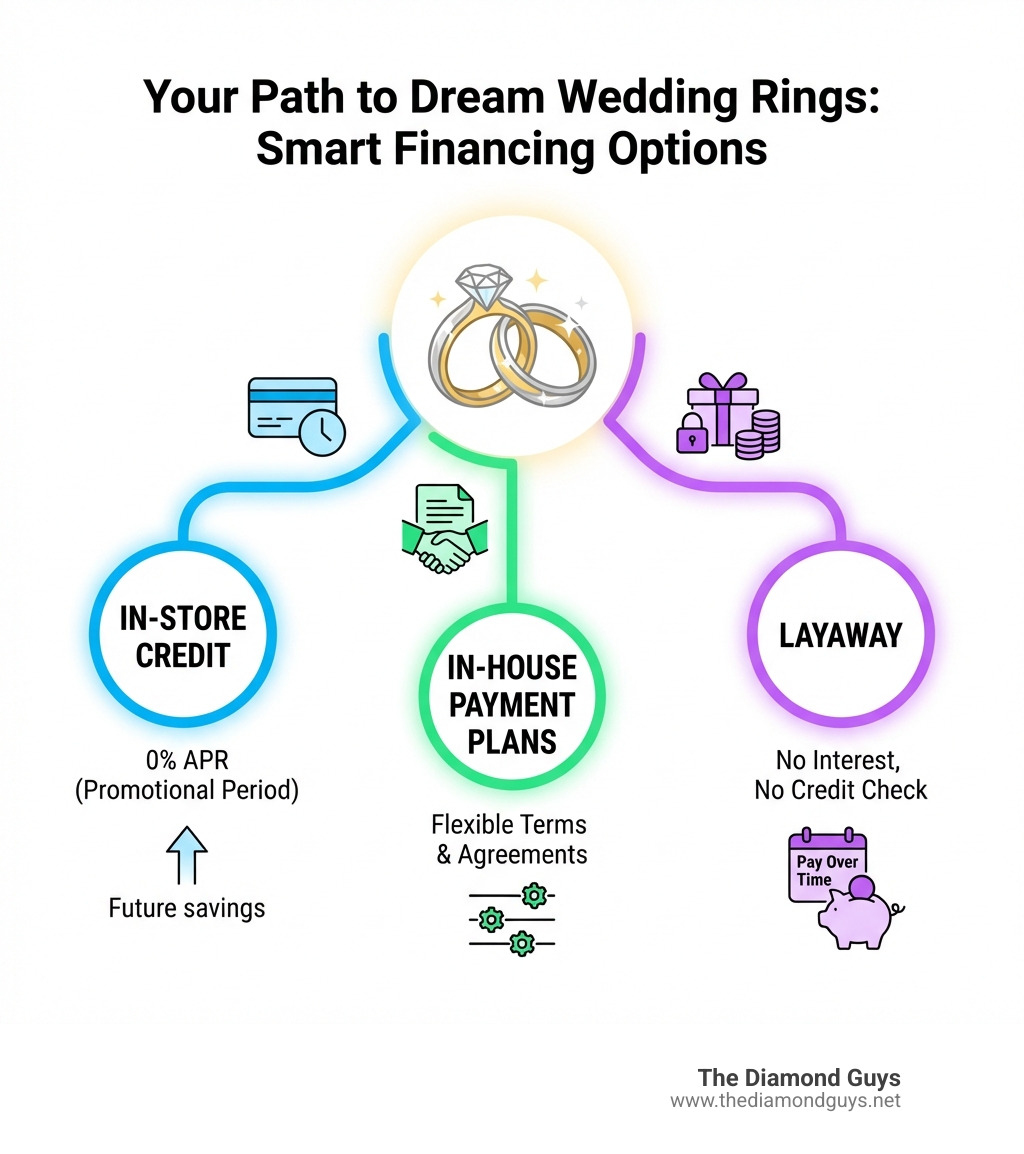

Financing turns a large, one-time expense into manageable monthly payments, making your dream rings a reality without breaking the bank. Common options include:

- Jeweler-Specific Credit Cards: Often feature promotional 0% APR periods.

- In-House Payment Plans: Direct, flexible agreements with the jeweler.

- Layaway Plans: Pay over time with no interest or credit checks.

- Third-Party Installment Loans: Spread costs over several months.

- Lease-to-Own Options: Flexible for various credit histories.

This guide will help you understand these choices so you can select your rings with confidence.

Understanding Your Wedding Ring Sets Financing Options

When you're ready to say "I do" to your dream rings, the financial aspect shouldn't be a roadblock. At The Diamond Guys, we know that finding the right wedding ring sets financing is as important as finding the perfect rings. We offer several pathways to make your purchase attainable without financial stress. This section breaks down our primary financing options to help you choose the best path for your situation.

In-Store Financing & Jewelry-Specific Credit Options

A jeweler-specific credit card or in-store financing program is an excellent way to manage the cost of fine jewelry. These programs often come with special benefits for larger purchases.

How They Work: We partner with reputable financial institutions to offer credit accounts for your jewelry. These allow you to pay over time with monthly payments. The application is straightforward, often with an instant decision.

Promotional 0% APR: A key benefit is the promotional 0% APR (Annual Percentage Rate) period, commonly 6 to 18 months. If you pay the full balance within this time, you pay no interest. This is a great way to spread out the cost, provided you stick to the payment schedule.

Deferred Interest Explained: It's vital to understand "deferred interest." If you don't pay the balance in full by the end of the promotional period, interest is charged retroactively from the purchase date. To avoid this, always pay off the balance before the promotion ends.

Minimum Monthly Payments: You'll have required minimum monthly payments, but these may not be enough to clear the balance in time. To avoid deferred interest, you'll likely need to pay more than the minimum each month.

Building Credit History: Using a jewelry credit card responsibly by making timely payments can help build or improve your credit score. For more details on financing, check out our guide: More info about financing engagement rings.

In-House Payment Plans

The Diamond Guys also offers in-house payment plans for wedding ring sets financing. These are direct agreements between you and us, designed for flexibility and accessibility.

How They Work: We work with you to set up a payment schedule that fits your budget. You'll make fixed monthly payments directly to us over an agreed-upon period. The terms are simple and easy to understand.

Interest Options: Depending on the plan, our in-house options may have simple interest or be entirely interest-free. We provide transparent terms so there are no unexpected costs.

Flexible Approval: In-house plans can offer more flexible approval criteria than traditional credit cards, making them a great option for those with less-than-perfect credit. We evaluate each situation individually.

Traditional Layaway Plans

For a straightforward, no-debt approach to wedding ring sets financing, our layaway plans are an excellent choice.

How Layaway Works: You select your rings, and we set them aside. You make a series of payments over an agreed period. Once the final payment is made, the rings are yours.

No Credit Check or Interest: Layaway requires no credit check and has zero interest charges. The price you see is the price you pay.

Secure the Price: Layaway locks in the current price of your chosen rings, protecting you from future price increases.

Payment Schedule: We establish a comfortable payment schedule with a small down payment. You receive your jewelry after the final payment is made, making the moment you take them home even more special. Our layaway plans are available for orders placed within the United States, including for our clients in Scottsdale, AZ, and Los Angeles, CA.

The Nitty-Gritty: Interest, Terms, and Credit Requirements

Understanding the fine print of any financing agreement is crucial. This section covers the critical details you need to know before signing, from interest rates to credit requirements, so you can feel fully informed.

Are There Interest-Free Options for Wedding Ring Sets Financing?

Yes! We offer several paths to interest-free wedding ring sets financing.

0% APR Promotions: Many of our in-store financing options include promotional 0% APR periods (e.g., 6, 12, or 18 months). This lets you get your rings now and pay them off over time without interest, as long as you meet the terms.

The Deferred Interest Trap: Be vigilant with 0% APR offers that use "deferred interest." If you don't pay the entire balance by the end of the promotional period, all the interest that would have accrued from day one is added to your balance. To avoid this, plan to pay more than the minimum monthly payment to clear your balance in time.

If you would like a neutral, third-party explanation of how this works, the Consumer Financial Protection Bureau's overview of deferred interest is a helpful reference.

Layaway as a Truly Interest-Free Option: For a worry-free, interest-free experience, our layaway plan is your best bet. It doesn't involve credit, so there's no interest to defer or accrue. You simply pay the sticker price over time.

What Credit Score Do I Need to Finance a Wedding Ring?

The required credit score for wedding ring sets financing depends on the option you choose.

General Credit Score Ranges:

- Excellent Credit (750+): You'll likely qualify for the best terms, including the longest 0% APR promotions and lowest standard interest rates.

- Good Credit (670-749): Most in-store credit programs are accessible, often with good 0% APR offers.

- Fair Credit (580-669): Options might include shorter 0% APR periods or installment plans with a moderate APR. Our in-house payment plans also offer flexibility for this range.

- Poor or No Credit: Traditional credit can be challenging, but our layaway plan requires no credit check. Lease-to-own options, available to our clients in Arizona and California, also cater to a wide range of credit histories by focusing more on income.

How Your Score Impacts APR: A higher credit score generally means a lower Annual Percentage Rate (APR) if you carry a balance. A lower score typically results in a higher APR.

Understanding Loan Terms: Down Payments and Repayment Periods

Beyond interest, understanding down payments and repayment periods is key.

Zero Down Payment Financing: Many of our financing programs offer "zero down payment" options on qualifying purchases, letting you take your rings home without an upfront cost.

How a Down Payment Helps: While not always required, a down payment reduces your monthly payments and the total amount of interest you might pay. It also makes it easier to pay off the balance during a promotional period.

Typical Financing Lengths: Repayment periods vary:

- Short-term: 3, 6, or 12 months are common for 0% APR promotions.

- Medium-term: 24 or 36 months are often available with a set APR.

- Long-term: Some plans extend to 48 or 60 months for larger purchases.

Short-term loans mean higher monthly payments but less total interest. Long-term loans offer lower monthly payments but you'll likely pay more in total interest over time. Always calculate the total cost before committing.

To help you visualize, here's a comparison of our financing options:

| Feature | In-Store Credit (Jeweler Credit Card) | In-House Payment Plans | Traditional Layaway Plan |

|---|---|---|---|

| Interest | Often 0% APR promo (deferred interest) | May be simple interest or 0% | 0% (always) |

| Credit Check | Required | Sometimes required, flexible criteria | Not required |

| Down Payment | Often 0% down available | Typically required | Typically required |

| When You Get the Ring | Immediately upon approval | Immediately upon approval | After final payment |

| Payment Terms | 6, 12, 18, 24, 36, 60 months (variable APR) | Flexible, fixed monthly payments | Flexible, regular payments |

| Builds Credit | Yes, if managed responsibly | No (typically) | No |

| Fees | Late fees, returned payment fees (potential) | Late fees (potential) | None |

How to Apply for Financing: A Step-by-Step Guide

Applying for wedding ring sets financing should be a clear and stress-free process. This guide will help you steer the application with confidence.

Step 1: Determine Your Budget and Ring Style

Before applying, it's wise to lay some groundwork.

Set a Realistic Budget: Consider your overall wedding expenses to determine what you can comfortably allocate to your rings and what monthly payment fits your lifestyle. The average ring cost is just a guide; your ideal budget is personal.

Choose Your Ring Style: Knowing the style, materials, and any custom elements you want helps us provide accurate pricing and define the total cost to be financed. For inspiration, explore our guides to custom wedding bands and men's wedding bands.

Step 2: Check Your Credit and Gather Documents

Understanding your financial standing is a powerful first step.

Check Your Credit Score: Many services let you check your credit score for free without impacting it. Knowing your score gives you a realistic idea of the financing options you'll likely qualify for. A score of 670 or higher generally opens up more favorable terms.

Gather Required Information: For credit-based financing, you'll typically need:

- A valid government-issued photo ID.

- Your Social Security Number (SSN).

- Proof of income (e.g., recent pay stubs).

- Your current address and contact information. Having these ready will make the application process smooth.

Step 3: Choose The Diamond Guys and Explore Financing Paths

With your budget and documents ready, you can explore your options with us!

Explore Our Financing Options: We pride ourselves on offering a variety of wedding ring sets financing solutions. Visit our Scottsdale, AZ, or Los Angeles, CA locations, or browse our website to learn about our programs.

Ask Questions and Compare Offers: Our team is here to help. Ask about APRs, promotional periods, and the terms of our in-house and layaway plans. Compare the total cost, monthly payments, and interest rates to find the best fit for your budget.

Read the Fine Print: This is crucial. Always read the terms and conditions before signing. Pay close attention to details about deferred interest and late payment penalties. We believe in transparency and are here to clarify any part of the agreement. As one of the Top spots for engagement and wedding rings, we're committed to making your purchase a joyful experience.

Frequently Asked Questions about Wedding Ring Sets Financing

We know that navigating wedding ring sets financing can bring up questions. Here are answers to some common inquiries to help you feel more confident.

How do in-house payment plans compare to traditional financing?

Our in-house payment plans are a direct agreement between you and The Diamond Guys, offering a distinct alternative to traditional financing like credit cards issued by third-party banks.

In-house plans often have more flexible approval criteria, making them accessible even if you have a developing credit history. The terms are straightforward, with manageable monthly payments that may even be interest-free.

In contrast, traditional financing involves a credit check and is reported to credit bureaus, which can impact your credit score. While they often feature attractive 0% APR promotions, they come with a high standard APR if the promotional balance isn't paid off in time. We can help you compare both options to find the best fit.

Are there hidden fees when financing a wedding ring set?

At The Diamond Guys, transparency is paramount. While we aim for straightforward financing, it's important to be aware of potential fees. These can include late payment fees or returned payment fees, which are standard across most loan products.

The biggest potential cost to watch for is deferred interest on 0% APR plans. As mentioned, if the promotional balance isn't paid in full by the deadline, all the interest from the purchase date is retroactively added to your account. This isn't a "hidden" fee, as it's in the terms, but it can be an unwelcome surprise if you're not prepared.

Can I finance a custom wedding ring set?

Absolutely! We specialize in creating custom rings for our clients in Scottsdale, AZ, and Los Angeles, CA, and we believe in making them financially accessible.

You can use any of our available wedding ring sets financing options for a custom design. The process is the same as for a ready-made ring. Once you've finalized your design and received the total price, you can apply for financing for that amount. Our team will guide you through every step, ensuring your journey from concept to custom ring is smooth and stress-free.

Conclusion: Say 'I Do' to Your Dream Rings with Confidence

Choosing your wedding rings is a momentous occasion that shouldn't be overshadowed by financial stress. Understanding your wedding ring sets financing options empowers you to get the rings you love without straining your budget.

Financing is a powerful tool that turns a significant investment into manageable payments, opening the door to higher quality or custom designs. However, responsibility is key. Always understand the terms, especially regarding deferred interest on 0% APR promotions, and make timely payments. For a simple, credit-free path, layaway is a fantastic, interest-free choice.

At The Diamond Guys, our teams in Scottsdale, AZ, and Los Angeles, CA, are dedicated to providing transparent information and personalized support. We'll help you select the financing plan that best suits your needs.

Don't let budget concerns hold you back. With the right knowledge and our support, you can say "I do" to your dream rings with absolute confidence.